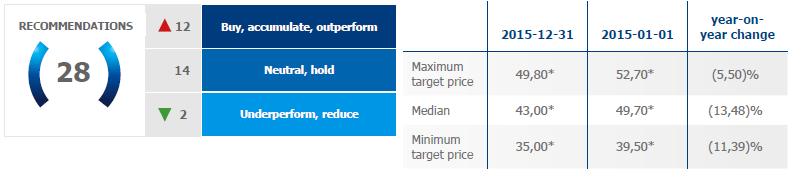

In 2015, PZU stock recommendations were issued by 18 domestic and international financial institutions. In total, sell side analysts issued 28 recommendations. The greatest percentage of recommendations were positive and neutral - 92.9% of all the recommendations issued.

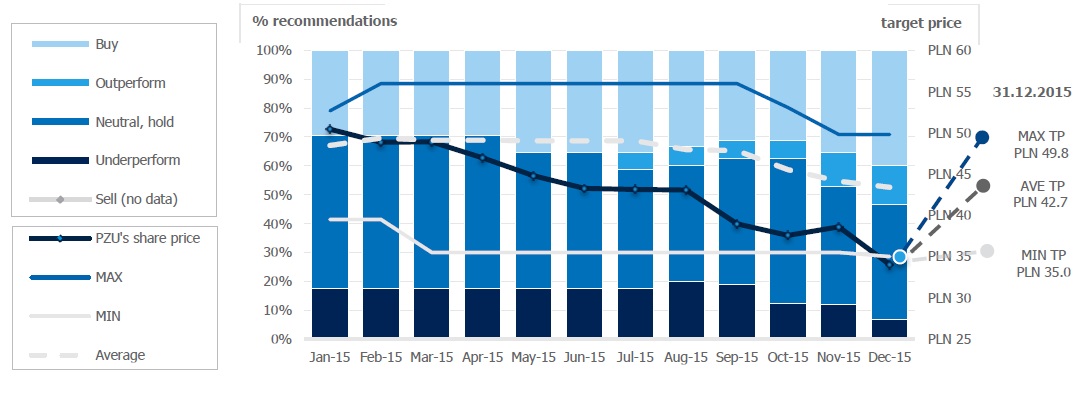

In 2015, recommendations for PZU shares were issued by 18 domestic and foreign financial institutions. In total, the sell-side analysts issued 28 recommendations. Positive and neutral recommendations dominated (92.9% of total recommendations issued.) The median of target prices (TP) from the recommendations valid in December 2015 amounted to PLN 43.00 and was lower by 13.5% compared with median as at the beginning of the year. Analogically, the maximum target price was PLN 49.803 and was 5.5% lower, compared to the maximum target price from January 2015.

The valuation of PZU shares by analysts was most significantly influenced by assumptions concerning growth and yield of insurance operations, achieved investment result and expectations towards dividend.

The valuation of PZU shares by analysts was most significantly influenced by assumptions concerning growth and yield of insurance operations, achieved investment result and expectations towards dividend.

A considerable discrepancy between valuations of respective analysts and PZU market valuation, that was observable at the end of 2015, constitutes an evidence that the market valuations are isolated from the fundamental value. That situation was related e.g. to weakening investors’ sentiment towards shares on global markets (concerns related to situation in china, low oil prices, migration crisis), as well as such local factors in Poland as announcements concerning introduction of tax on financial institutions, etc. Additional burden for PZU shares was growing uncertainty as to further investments in consolidation of the banking sector in Poland and expected personal changes in the Management Board of PZU.

Recommendations and target prices scheme in 2015

Analysts’ expectations towards PZU share price in 2015 on the basis of recommendation updated as at end of December 2015

Institutions issuing recommendations for PZU shares in 2015

POLAND

| Institution | Anslyst | Phone number | |

| Deutsche Bank | Marcin Jabłczyński | +48 22 579 87 33 | marcin.jablczynski@db.com |

| DM mBank | Michał Konarski | +48 22 697 47 37 | michal.konarski@mdm.pl |

| DM BH (Citi) | Andrzej Powierża | +48 22 690 35 66 | andrzej.powierza@citi.com |

| Haitong Bank | Kamil Stolarski | +48 22 236 92 31 | rokicka@ipopema.pl |

| Ipopema Securities | Iza Rokicka | +48 22 236 92 31 | rokicka@ipopema.pl |

| DM ING | Piotr Palenik | +48 22 820 50 20 | |

| DM PKO | Jaromir Szortyka | +48 22 580 39 47 | jaromir.szortyka@pkobp.pl |

| DM Trigon | Hanna Kędziora | hanna.kedziora@trigon.pl | |

| Wood & Company | Marta Jeżewska-Wasilewska | +48 22 222 15 48 | marta.jezewska-wasilewska@wood.com |

OTHER COUNTRIES

| Institution | Analyst | Phone number | |

| Barclays Capital | Ivan Bokhmat | +44 20 7773 0417 | ivan.bokhmat@barclays.com |

| Credit Suisse | Richard Burden | +44 20 7888 0499 | richard.burden@credit-suisse.com |

| ERSTE | Thomas Unger | +43 50 1001 7344 | thomas.unger@erstegroup.com |

| Exane BNP Paribas | Thomas Jacquet | +33 142 99 51 96 | thomas.jacquet@exanebnpparibas.com |

| HSBC | Dhruv Gahlaut | +44 20 7991 6728 | Dhruv.gahlaut@hsbcib.com |

| JP Morgan | Michael Huttner | +44 20 7325 9175 | michael.huttner@jpmorgan.com |

| Raiffeisen Centrobank | Bernd Maurer | +43 1 51520 706 | maurer@rcb.at |

| UBS | Michael Christelis | +27 11 322 7320 | michael.christelis@ubs.com |

| Societe Generale | Jason Kalamboussis | +44 207 762 4076 | jason.kalamboussis@sgcib.com |