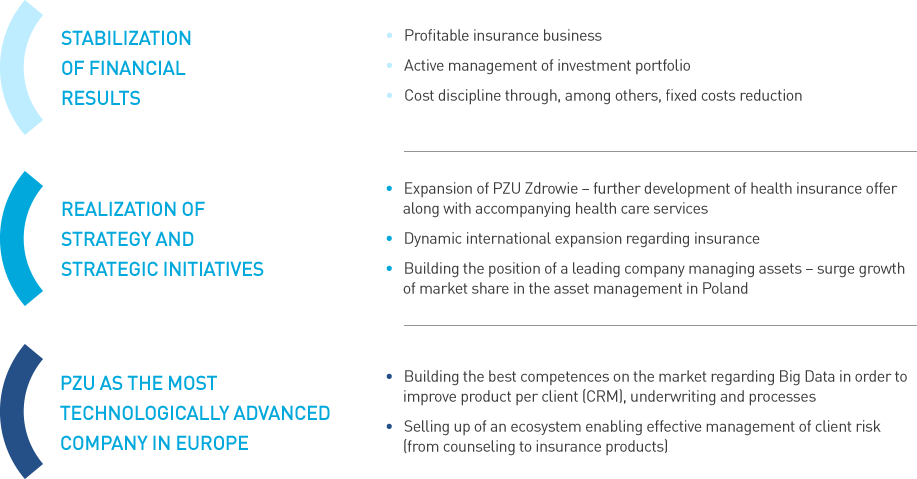

PZU’s major strategic objectives up to 2020 are to stabilize the financial results, tap into its growth potential to a greater extent and create the most innovative group in Europe.

Dynamically changing business and legal environment forces the Group to strike a balance between pursuing previously determined strategic operations and searching for innovative solutions by means of thorough data analysis and skillful experimentation.

“Strategy is in principle change management”

Professor Arnoldo C. Hax, MIT Sloan School of Management

Development directions of PZU Group in the years 2016-2020:

- Staying client-centric – We are here to ensure our Clients’ peace of mind and security. Our Clients can always rely on us. The Group’s mission in practice translates into transforming PZU from a product-centered organization into a company that focuses on the clients’ needs;

- Strengthening the position of a leader at the insurance market in Poland;

- Retail Client Area – maintaining the market leadership by using the comprehensive offer that fits the needs of relevant client segments and the strategy of two brands (PZU and Link4);

- Corporate Client Area:

- (in non-life insurance) strengthening the position of a market leader, especially in Mid-Corpo client segment, and achieving the status of a business partner with strong expertise that provides not only insurance products, but also guidelines and support to the clients at every stage of risk management process;

- (in life insurance) maintaining the position of market leader along with high profitability, irrespective of strong competition pressure;

- Foreign operations:

- Dynamic increase in contribution of GWP from foreign countries;

- Focus on profitability and achieving high return on investments.

- Development of auxiliary insurance offer by introducing the following:

- customer asset management;

- medical insurance;

The catalyst of change to improve profitability is also to optimize the level of expenses by cutting fixed expenses by approximately 20% within 3 years (compared to 2015). The new investment strategy is supposed to stabilize the financial result making it possible to maintain its investment yield in investment despite low interest rates. The insurance sector undergoes numerous changes and transformations, which result in the insurers focusing on client’s needs. The important direction of changes consists in creating products whose terms of conditions are simple and transparent and that the clients can easily compare. Competing under demanding market conditions forces the insurers to endlessly strive to expand and improve through optimizing the applied business models and extensive application of the analytical tools that use Big Data.

Further development of PZU Group will progress under conditions determined by the following main trends and factors:

- Low interest rates

In the next few years, PZU Group will operate in the environment where low interest rate will prevail. The forecasts concerning inflation in both Poland and the Eurozone indicate no considerable probability of the inflation growth to the level of 2% earlier than near the end of the Strategy’s horizon. This situation will continue to produce a difficulty in achieving a guaranteed rate of return in life insurance, and also it will have a considerable impact on the formation of the rates of return demanded by the investors, which are possible to achieve by investment and pension fund. - Growing regulative requirements

Solvency II

The regulations of the Solvency II directive establishing the requirements concerning key financial parameters of insurance activity came into effect on 1 January 2016. The new regulations change the way of establishing the capital solvency requirement for insurance companies. According to the new regulations, these requirements will be established separately for insurance (actuarial), market and operating risk. By tightening regulative requirements, the Directive considerably changes the insurance market. Its implementation affects both premium calculation and changes to the internal processes of insurance companies, mainly in the scope of risk management. According to the new regulations, insurers are obliged to report the new extended information scopes to superior institutions and make them public. Resulting from the implemented changes, certain companies will face the need for capital injection or limitation of their operating scope.

Asset tax

The tax on assets of financial institutions came into effect in Poland as of 1 February 2016. For insurers, the tax rate is 0.44% of the collected assets. This tax will cover many insurance companies operating in Poland, but the biggest part of its generated revenue will come from the tax on PZU Group’s assets. It is estimated that the tax may amount to approx. PLN 270 - 280 million (applies only to insurance companies, annualized data).

Changes to the Act on Insurance Activity

The changes to the Act on Insurance Activity also came into effect in early 2016. The implemented changes are mainly oriented towards formation of relations with clients. In this case, the changes will mostly affect life insurers, including the requirement to keep detailed analyses of the client’s needs in sales of products with investment capital funds and providing the client with appropriate recommendations and guidelines. The regulations on paying commission to insurance agents have changed, which will lead to changes in the sales of insurance products, especially through agents.

- Client’s expectations

In recent years, financial products, especially life insurances, became so complicated that clients tend to search for simpler and more transparent solutions, the so-called products without fine print. The products whose structure will be clear and understandable, regardless of the level of clients’ economic knowledge. Product transparency means e.g. a shift from comprehensive solutions combining elements of insurance and investment. Meanwhile, in the case of non-life insurance products there is a constant pressure on price, which forces the insurers to compete not only on the scope of a basic service, but also the scope of additional services (assistance, direct claims handling, concierge). This requires the insurers to develop both comprehensive and flexible approach to the pricing of offered services. - Strong demographic trends and resulting changes in purchasing behavior

The strong demographic trends will lead to quick changes in the age structure of the society and, simultaneously, to the purchasing behavior of the Group’s clients. The number of people aged 60 and up, mostly still professionally active, with broad and diverse needs for all kinds of insurance (including medical insurance) and saving products (asset management) will quickly rise, especially throughout the realization of the main directions of the Group’s development horizon. Simultaneously, there will be more “millennials” entering the labor market with lifestyles, preferences, and purchasing behaviors considerably different from their parents. This generation is much more used to all forms of digitalization in various aspects of life (including use of financial and insurance products). This forces the insurers, PZU included, to offer the products, as well as claims and benefits handling, through mobile channels, with the application of internet marketing and social media. - Growing importance of digital and mobile channel issues The next few years are often referred to as the period of “rapid digitalization”. It is expected that extensive use of new digital technologies will be one of the strongest trends up to the year 2020, in the scope of both the projected changes in the operating activity of insurance companies and the formation of their relations with the clients. It is expected that developed markets will see a very quick growth in the number of clients using digital channels to contact insurers within the next five years. Consequently, it will be necessary to adapt relations with the clients, but it will also be easier to decompose the value chain of insurance companies because of the escalated competition and transparent prices. At present, none of the companies operating in the financial sector should neglect remote channels as a form of distribution and client service.

- Greater potential to adapt to the client’s needs by using Big Data The combination of the rising role of digital channels in client relations and rapidly growing analytical potential creates a unique opportunity for companies operating in the financial sector – especially insurance companies. However, numerous changes in business processes and investments in the solutions allowing for collecting and processing vast amount of data are essential, as well as tools for modeling and analyzing client behavior, which will enable the application of historical data collected by the companies. The use and development of the above-mentioned tools allow for a more effective client segmentation, which in turn translates into a more flexible adjustment of the offer to the needs, as well as optimization of sales and marketing costs of an insurance company.