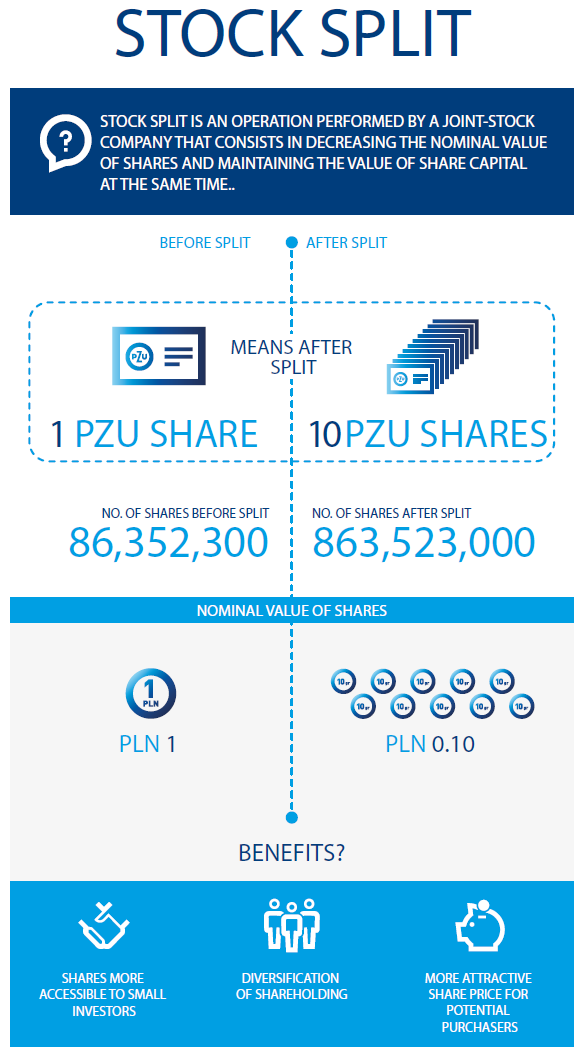

In November 2015 PZU conducted a share split. After completing it, the share price was reduced ten times while the number of outstanding shares rose ten times. At the end of 2015 PZU had the fourth highest capitalization among domestic companies with 5.7% of the WSE’s main market.

In 2015, WIG20, the largest Polish index was at levels exceeding 2,500 points; however, at the last session in the year its value was 1,859 points, thereby recording a 19.7% decline in comparison to 2014.

High geopolitical risk on the European markets was reflected in a high volatility of main indexes on the Warsaw Stock Exchange. Throughout 2015, the most important Polish index, WIG20, remained at levels exceeding 2,500 bps; however, during the last session in the year, its value amounted to only 1,859 points, which was a drop of 19.7% compared to 2014. The WIG index was slightly better and fell by 9.6% year-on- year. Small companies turned out to be the most resistant to decreases – the sWIG80 index gained 9.1% year-on-year. By comparison, the same index ended the year 2014 with a decrease of more than 15.5%.

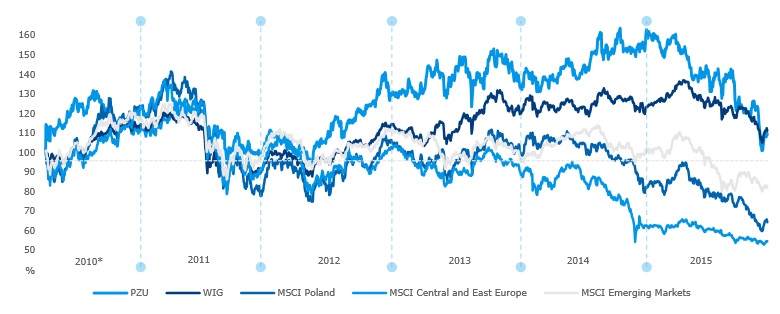

Dynamics of PZU’s share prices in relation to MSCI

* Share prices from 12 May 2010 (PZU’s IPO on WSE).

Source: Reuters

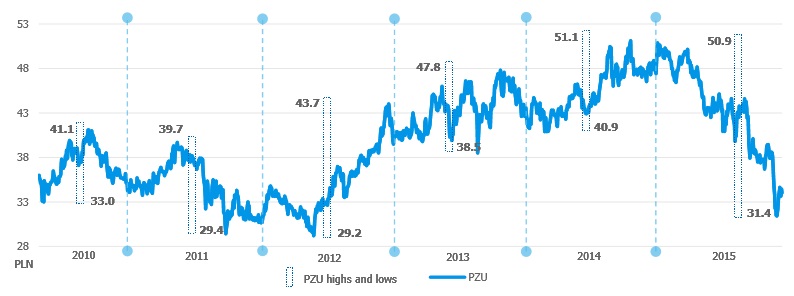

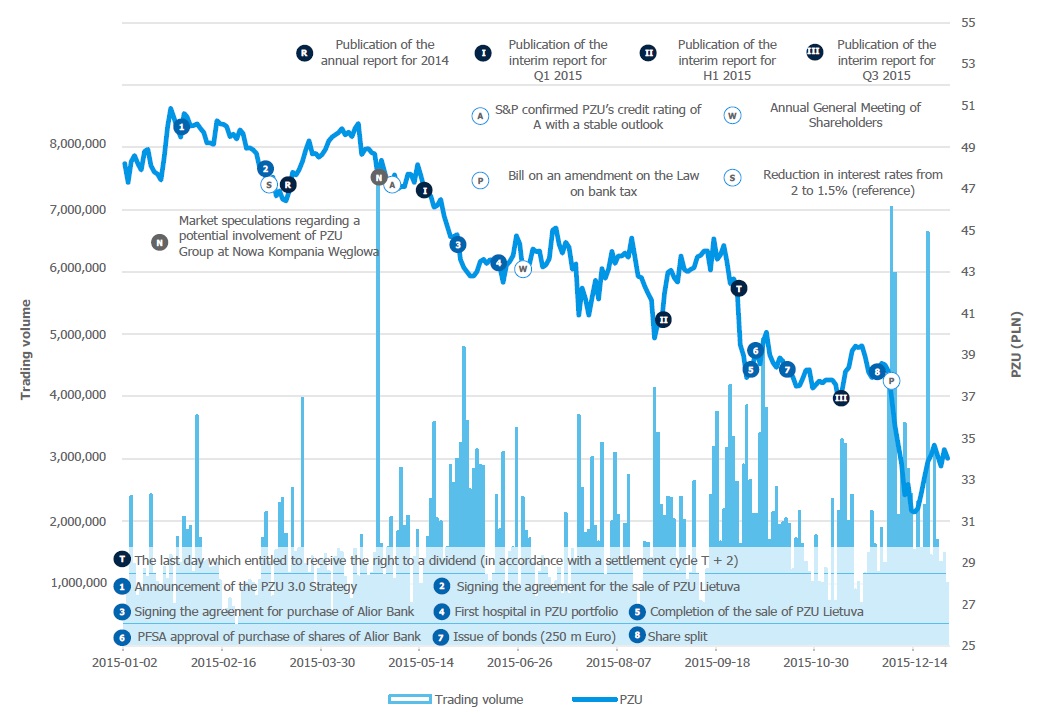

PZU share prices

PZU shares were first traded on the Warsaw Stock Exchange on 12 May 2010. Since its IPO, the company has been included in the WIG20, WIG, WIG30, WIG-Poland, and WIGdiv indexes. Since 2012, PZU shares have been also included in the sustainable development indexes, RESPECT and CEERIUS.

On 30 November 2015, PZU split its stock, the operation consisting in decreasing the nominal value of shares from PLN 1 to PLN 0.1. The split did not result in any changes in the shareholding structure, the operation was purely technical (i.e. without any influence on share capital). Following the split, the share price decreased 10 times and the number of shares increased 10 times. Split registration was preceded by an amendment to the By-laws made on 3 November 2015.

With capitalization amounting to PLN 29 billion, at the end of 2015, PZU was the fourth company when it comes to the capitalization of domestic companies (5.7% of share in the WSE main market). In 2015, maximum PZU share price (calculated after the split) amounted to PLN 50.9. The price reached its bottom on 14 December 2015 when it amounted to PLN 31.4 per share.

At the end of Q1 2015, PZU share prices were valued 11.0% better than in the same previous period of 2014, which was a very good result compared with WIG20 (a 2.7% drop year- on-year) or WIG Banks (a 12.5% drop year-on-year.) However, the subsequent quarters brought a market downturn. In a downward trend, PZU share value dropped faster than the main market indexes. The closing price from the last session in 2015 amounted to PLN 34.0 and 8.3% lower than the estimate as at the end of 2014. By comparison, the same WIG20 and WIG BANKS ended the year with a decrease of 19.7% and 23.5% respectively. The sale of shares concerned also RESPECT index whose closing price was 15,5% lower than in 2014.

High dividend paid by PZU on 21 October 2015 offered some conciliation to the investors. The dividend amounted to nearly PLN 2.6 billion, i.e. PLN 3.00 per share. The dividend rate (calculated in relation to the share price at the end of 2015, PLN 34.0) amounted to 8.8%. Since its IPO, PZU has already paid out nearly PLN 15 billion in dividends, while the Total Shareholders Return (TSR) for PZU shares amounted to 64.2%.

Min/max PZU share prices* following the session end in the years 2010-2015

* Share prices after a 1:10 split. Source: Reuters

Capital market ratios for PZU shares*

| Capital market ratios for PZU shares* | 2015 | 2014 | 2013 | 2012 | 2011 |

| P/BVMarket price per share / book value pershare | 2.27 | 3.19 | 2.95 | 2.64 | 2.07 |

| BVPSBook value per share | 14.97 | 15.25 | 15.20 | 16.52 | 14.90 |

| P/EPrice per share / profit per share | 12.54 | 14.14 | 11.77 | 11.60 | 11.38 |

| EPS (PLN)Profits (losses) per share / number of shares | 2.71 | 3.44 | 3.82 | 3.77 | 2.72 |

*based on PZU Group data (IFRS)

PZU shares are characterized by a high level of liquidity. An average spread in 2015 reached only 7 bps. Only two other main market entities recorded such a low spread value. The average number of transactions involving PZU shares per session was 3,329 (a 33.4% increase year-on-year). The highest trading volume, i.e. 7,528,870 items, was recorded on 24 April 2015, which resulted from market speculations regarding a potential involvement of PZU Group in the capital increase at Nowa Kompania Węglowa. PZU denied this information.

PZU’s shares are highly liquid. The average number of transactions in PZU shares per trading session was 3,329, signifying 33.4% growth compared to last year.Similarly high trading volume took place on 3 December 2015 when the lower house of Parliament (Sejm) received a draft of the tax on financial institutions. The market reacted negatively, which consequently led to a share price drop amounting to several percent (evidenced by high trading volume.)

PZU share price rate in 2015 continued to be strongly influenced by the decision to invest in consolidation of banking sector’s assets in Poland. On 30 May 2015, PZU concluded an agreement to purchase 25.19% Alior Bank shares at PLN 1.6 billion. The PZU Management Board planned to buy further banks to build an entity that would be one of five largest institutions in Poland when it comes to asset volume. However, by the end of 2015 the company did not manage to pursue further transactions. Moreover, the market price of share of banks quoted on WSE, including Alior Bank shares, are valued significantly lower, which resulted in the decreased capitalization of PZU.

As at the end of 2015, capitalization of WSE companies dropped by 9% and amounted to PLN 122 billion (including 26 new domestic entities that were first traded on WSE in 2015.)

The P/E ratio for domestic companies decreased in 2015 by 7.6% to 18.2 year-on-year, while the P/BV ratio fell by 15.3% to 1.1 year-on-year1. Share/Book Value ratio was 12,54, and Price/Book Value 2,27.

1 http://www.gpw.pl/analizy_i_statystyki

| PZU share statistics | 2015 | 2014 | 2013 | 2012 | 2011 |

| Maximum rate of shares* (PLN) | 50.9 | 51.1 | 47.8 | 43.7 | 39.7 |

| Minimum rate of shares*(PLN) | 31.4 | 40.9 | 38.5 | 29.2 | 29.4 |

| The exchange rate at the last session of the year*(PLN) | 34.0 | 48.6 | 44.9 | 43.7 | 30.9 |

| Average rate per session* (PLN) | 43.7 | 45.2 | 43.2 | 34.6 | 34.9 |

| Value of the volume (PLN million) | 20,144.56 | 18,400.72 | 19,970.38 | 18,152.22 | 23,315.25 |

| Average value of the volume per session (PLN million) | 80.3 | 73.9 | 80.9 | 73.2 | 92.9 |

| Number of transactions (item) | 835,471 | 621,224 | 585,205 | 411,635 | 526,265 |

| Average number of transactions per session | 3,329 | 2,495 | 2,369 | 1,66 | 2,097 |

| Trading volume** | 470,048,842.0 | 407,247,220.0 | 464,899,980.0 | 525,648,380.0 | 667,367,130.0 |

| Average trading volume per session (item)* | 1,872,704.5 | 1,635,531.0 | 1,882,186.2 | 2,119,549.9 | 2,658,833.2 |

| Capitalization at the end of the period (PLN million) | 29,377.1 | 41,967.2 | 38,767.9 | 37,736.0 | 26,682.9 |

Main events that influenced PZU share prices in 2015

Codes Quick Response (QR) for online transmission