2015 abounded in events that materially affected the financial markets. The commencement of the European Central Bank buying Eurozone treasury bonds led to record-breaking declines in the yield offered by German bonds and indirectly to the US dollar becoming much stronger. In turn, the Swiss central bank’s unpegging of the Swiss franc exchange rate precipitated a sharp strengthening of this currency.

A number of events that had a considerable impact on the financial markets took place in 2015. In late January, the European Central Bank announced its quantitative easing program and begun to buy treasury bonds of Eurozone states. Consequently, the German 10-year bond yields were decreasing in subsequent months to the lowest historical levels, and temporarily amounted to less than 0.1%. Simultaneously, German stock exchange indices were exceptionally high. Both shares and treasury bonds were more expensive also on the Polish market.

The expected increase of interest rates by the US Federal Reserve in 2015, contrasted with an extraordinary easing of monetary policy in the Eurozone, resulted in a significant strengthening of US dollar versus the common European currency in Q1 2015. The differences in monetary policy and in the perceived economic outlook in the Eurozone and the USA contributed to a larger difference between the German and US 10-year treasury bond yields that reached the highest level in years.

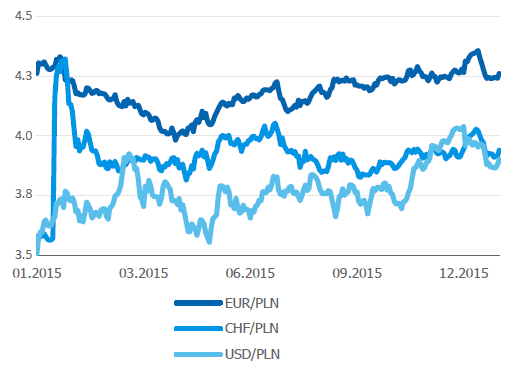

Making the Swiss franc exchange rate free-floating by the Swiss central bank in mid-January was another significant event in early 2015. The minimum EUR/CHF exchange rate of 1.20 was abolished. This decision resulted in a rapid strengthening of the Swiss currency also versus the Polish zloty.

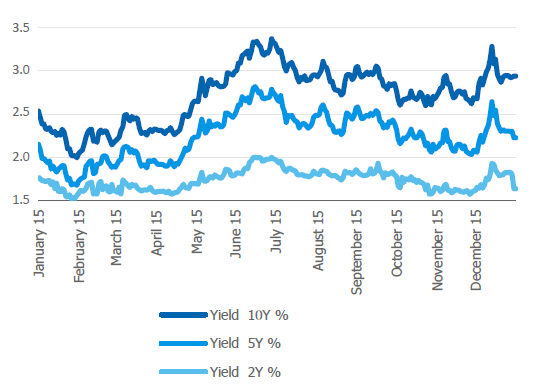

The Monetary Policy Council’s decision to lower the National Bank of Poland reference rate to 1.50% in March 2015, which ended the monetary policy easing cycle, was exceptionally significant for the Polish treasury debt securities with shorter maturity periods.

In late April and early May 2015 atmosphere on the financial markets begun to change fundamentally. Prices of shares and bonds started to drop, especially in Europe. Quieting down the fears of strengthening deflation in Eurozone contributed to a change on the interest rate market. A higher risk aversion on financial markets, i.e. due to the problematic situation in Greece and the Russian-Ukrainian conflict, adversely influenced the stock market situation. The tension escalated in late June 2015 when the Greek Prime Minister A. Tsipras announced a referendum on accepting the terms and conditions of the aid scheme for the country.

In the stormy first half of 2015, the Polish 10-year treasury bond yields reached both the lowest and the highest level of the year. They first dropped from 2.54% to 2.00% at the end of January and then increased to 3.37% at the end of June. In late April and early May the WIG index exceeded the value of 57 thousand points, growing by nearly 12% since the end of 2014. However, its drop in the second half of May and June removed most of the previous increase.

Three key issues influenced the financial market trends in August and September 2015. First of all – the situation in China where the prices on the stock market collapsed in mid- August 2015, causing strong global turbulence. Secondly –a possibility that the European Central Bank would extend and prolong the quantitative easing program which was due to finish by September 2016. Thirdly – it was expected that the Federal Reserve would decide on the potential interest rates increase in the USA, which eventually did not take place in September.

In Q3 2015, the Polish yield curve significantly dropped and flattened. Externally, low yields were maintained as a result of the ECB’s and Fed’s monetary policy, which proved more accommodative than expected. What is more, persistently low inflation in Poland and the expected outcome of Polish election suggested that accommodative monetary policy in Poland would be maintained. Regulations on the insurance and financial markets in Poland.

That period proved unfavorable for the stock market. Share prices decreased not only in Poland, but also globally.

Equity prices plummeted not only in Poland but also on international markets. Originally, concerns for the financial position of Greece contributed to these declines. They grew more pronounces as a result of China’s deteriorating economic and market position. The announcements of changes to taxation in the banking sector formed an additional burden.

Initially, the decreases resulted mainly from concerns related to the situation of Greece. They grew stronger along with the deteriorating economic and market situation in China and its potential implication for the global economy, especially „emerging markets”. An additional burden for several companies on the Polish market – especially from the banking sector – were the media announcements of potential statutory changes, which might have negative effects on such companies’ operations (including the so-called financial institution tax) and were likely to be introduced after parliamentary elections in October 2015.

Decreases in WSE indexes escalated in the last months of 2015. WIG20, an index of the largest companies, reached nearly 1700 points for the first time since 2009. After the peak in May, WIG dropped by nearly 24%. Several factors contributed to that situation. The US central bank increased the federal funds rate by 25 bps in December. That had been the first increase since 2006. The European Central Bank eased its monetary policy in December; however, the scale of easing was narrower than expected by the market. At the same time, the concerns related to the situation on emerging markets grew stronger. Raw material prices were going down. External risks and announcement of regulatory changes to affect e.g. the banking sector proved to be an additional burden for the Polish stock market, especially WIG20 index.

Treasury bond yields in 2015

The same factors had a strong influence on the Polish treasury bond market and led to the Polish yield curve growing steeper. In Q4 2015, the Polish 10-year treasury bonds yields slightly increased. At the same time, interest rates in Poland were expected to decrease, which led to a lower yield for bonds with shorter maturity dates.

Finally, in entire 2015 the Polish one-year treasury debt securities yield dropped by approximately 30 bps to around 1.50%. Five and ten-year bonds yields increased by approximately 10 and 40 bps, respectively. The difference between 10-year and one-year bonds yield increased by around 70 bps. Correlation between the yields in Poland and yields on key global markets, such as Germany or the USA, remained high.

At the same time in 2015, WIG20 stock index dropped by nearly 20%, whereas WIG decreased by almost than 10%.

The currency market in 2015 was dominated by the trend of the strong appreciation of the US dollar to the euro, which was, however, less clear than in 2014. Still, the euro lost as much as 10.2% to the US dollar. The PLN to USD exchange rate also changed – the dollar cost 11.2% more than at the end of 2014. The PLN significantly weakened in relation to the Swiss franc and dropped by 11.1%. Yet, the Polish currency remained stable against the euro.

PLN rate in 2015